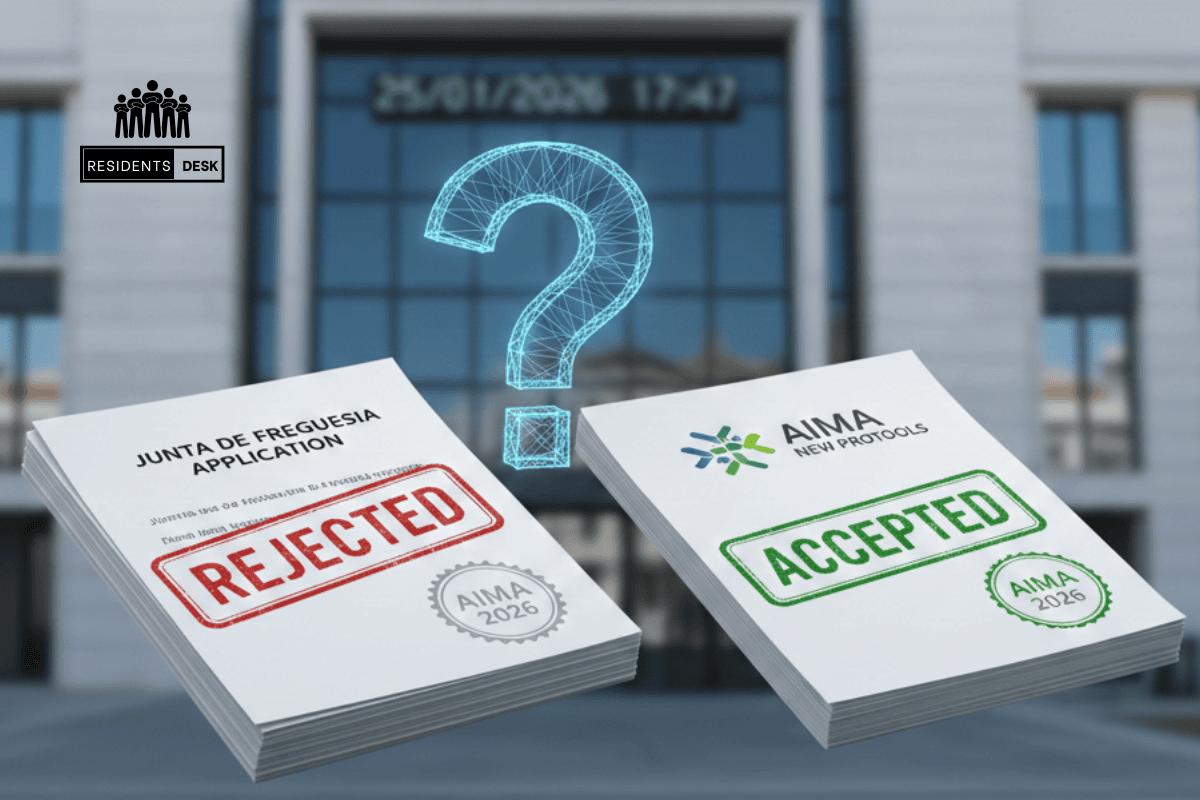

You are likely reading this because you presented an Atestado de Residência from your local Junta de Freguesia at an AIMA appointment, and the officer refused to accept it. You may have been told the document is “insufficient” or “not verifiable” under current 2026 internal protocols. This refusal often happens without a detailed explanation, leaving you concerned about the status of your residency application.

It is common to feel anxious when a standard document is declined. We understand that you have followed the traditional advice found on most websites, only to face a different reality at the service desk. This situation does not mean your application is automatically denied. It means AIMA now requires higher-tier proof of address that links directly to official government databases.

Why Did AIMA Rejected Your Junta de Freguesia

In 2026, AIMA has shifted its focus toward “primary source” documentation. A Junta certificate is a secondary document based on witness testimony. AIMA now prioritizes documents that exist within the Tax Authority (Finanças) or Social Security systems.

This rejection does not mean you are in legal trouble. It means you must provide a document that the AIMA system can verify digitally through the Interoperability Platform of Public Administration (iAP).

Which Documents Now AIMA Accepts for the Proof of Address?

The system currently prioritizes documents that prove a legal, financial connection to a specific property. If AIMA rejected your Junta de Freguesia in 2026, it means they are looking for one of the following scenarios based on your specific living situation.

Case 1: You are a Tenant with a Contract in Your Name

If your name is on the lease, the Junta certificate is considered redundant and often insufficient on its own.

- What to do: Log into the Portal das Finanças and download your Contracto de Arrendamento (Rental Contract) that has been officially registered and stamped by the Tax Authority.

- The requirement: The contract must be accompanied by the latest Recibo de Aluguer (Rent Receipt). AIMA officers use the “Verification Code” on these receipts to confirm the lease is active in the government database.

Case 2: You are a Tenant but the Contract is NOT in Your Name

This is the most frequent cause of rejection. If you rent a room or live with friends without a formal contract in your name, a Junta certificate is rarely accepted in 2026.

- What to do: You must obtain a Termo de Responsabilidade (Statement of Responsibility) signed by the person whose name is on the official Finanças lease.

- The requirement: This person must provide a copy of their ID and a copy of the registered lease. You are essentially “linking” your presence to a verified taxpayer’s address.

- You will be asked to give the declaration from the property owner, stating that you are living there and paying rent. Sometimes, the declaration from the contract holder is acceptable, but it is highly suggested that you go for declaration from property owner.

Case 3: You are a Student Living in a University Residence

Students often face issues because university housing does not issue standard tax-stamped rental contracts.

- What to do: You need an official declaration from the University Housing Services (SAS) or the private residence management.

- The requirement: This document must be on official letterhead, signed, and stamped. It must explicitly state the duration of your stay and your fiscal number (NIF). AIMA now cross-references your NIF with the address provided by the school.

Steps to Fix Your Address Proof

If your document was rejected, the officer likely gave you a deadline (usually 10 to 15 business days) to upload new evidence via the AIMA portal or submit it via registered mail (Correio Registado).

- Update your NIF address: Ensure your address on the Finanças website matches the address on the new document you intend to submit.

- Request a “Certidão de Domicílio Fiscal”: This is a free document you can download from the Finanças portal. In 2026, this is often the most “trusted” document for AIMA because it proves the Tax Authority recognizes your residency.

- Request Declaration from Property Owner: It is advisable to ask for declaration from your property owner. This declaration is considered most appropriate in the case of AIMA.

- Use the CTT Portal: If you must mail documents, use the CTT Object Tracking service to keep a record of the delivery to the AIMA headquarters.

The system is looking for a digital paper trail. By moving away from the Junta certificate and toward Finanças-verified documents, you align your application with what the system is programmed to accept.

If you have any questions or queries, you can use our contact form.